Destinations of Choice

Opening Up the Market

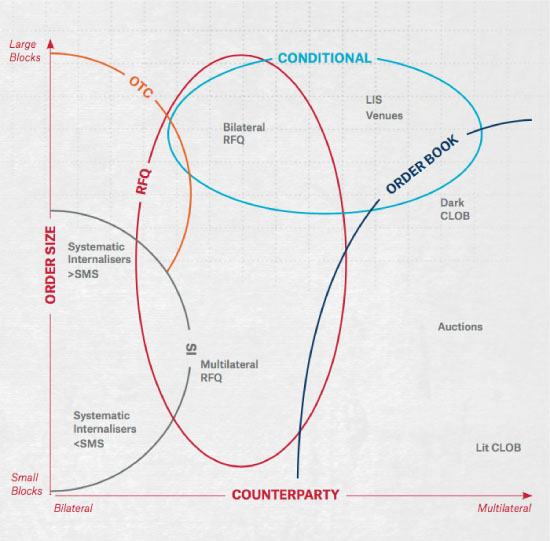

The choices start with selecting the optimal type of venue: should your order be routed to a Regulated Market ("RM") or a multilateral trading facility ("MTF")—regulated trading venues required to provide nondiscriminatory access—or, directly to a Systematic Internaliser ("SI")? RMs and MTFs are able to cross buyers and sellers and may benefit from pre-trade transparency waivers. SIs, on the other hand, must trade on risk but benefit from being able to price improve relative to their published quotes as well as keep their quotes private when they deal above standard market size (SMS).

For a buy-side firm, the trading options are not limited to traditional multilateral venues such as dark pools operating within central limit order books ("CLOBs"). Indeed, bilateral protocols such as SIs and requests-for-quote ("RFQs"), as well as the increasing use of conditional trading via Indications of Interest ("IOIs"), are at the forefront of this new, more open marketplace.

Around the block

The diversification in trading choices responds to a clear (though not necessarily loud) investor need. Buy-side firms, especially the larger ones, have an ongoing requirement to efficiently and quietly manage trillions of euros in assets. As a result, much of their business is conducted in Large in Scale (LIS)—or block— orders. This enables them to process what may be the equivalent of many days’ worth of trading volume in a particular security.

Fragmentation = Competition = Choice = Complexity

Those familiar with the evolution of algorithmic trading over the last decade know well that the trend had previously been a reduction in order size, since that is how execution algorithms achieved their liquidity capture and price efficiency. Under the emerging landscape, blocks again represent a compelling portion of the marketplace, both because of the efficacy of getting orders done in a single execution and because they are exempted from the dark pool volume caps under MiFID II/MiFIR (which do not apply to orders above LIS, RFQ venues or SI transactions).

While algo trading will remain popular as a method of working large orders in the wider market, some of the newer trading venues offer the advantages of conditional access, pre-trade price and counterparty transparency, and tailored liquidity. This provides even greater potential for discreetly finding and executing a block—and thus reducing market impact.

Clearing the way

We should not forget that while execution is important, the total cost of trading extends across the investment lifecycle, including clearing and settlement. Under MiFID II, all trading venues (RMs and MTFs) are required to open up to any central counterparty ("CCP") that requests it. Central clearing has a number of cost, credit, and efficiency benefits that are making it increasingly attractive to many institutional investors.

Ultimately, the choice of how to trade will depend on the specific situation of the client. The good news is that there are now more choices than ever to address what has become a complex web of trading venues, buy-side requirements, and sell-side provision and facilitation.

Over the past decade, a myriad of trading venues have sprung up, increasing the range of options for investment firms. This is enabling participants to exercise greater choice as they try to accurately and efficiently manage their increasingly sophisticated trading workflow. But it’s not making trading any easier, particularly as the cost of regulatory compliance and continuous technology investment stacks up against an increasingly competitive environment.

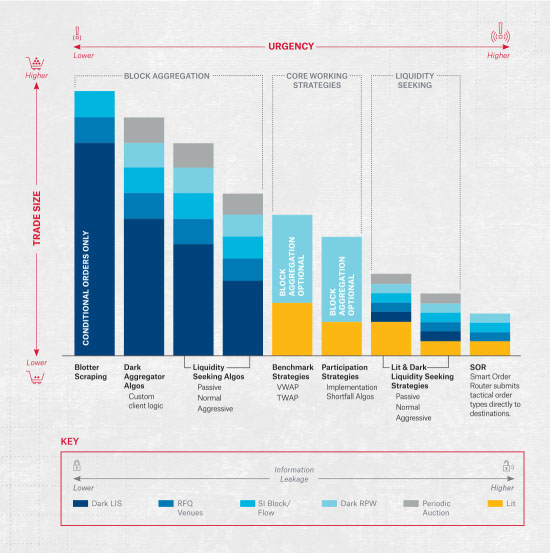

All participants need new sets of tools and fresh ways of thinking to thrive in an expanding, automated, high-speed trading ecosystem. Indeed, executing with the stealth, speed, and efficiency needed to minimise information leakage and market disruption has become mission-critical. As a result, investment firms need to be able to "virtually" manage multiple conditional venues, IOIs, SIs, and RFQ opportunities in one integrated real-time trader cockpit.

Venue choices

Execution choices are growing, but in the background a consistent push from European governments is aiming to move the majority of trading onto venues, a trend that began in the aftermath of the 2008 financial crisis. As a result, the share trading obligation means that all trading in MiFID governed shares must take place on regulated markets, MTFs, SIs or equivalent third-country trading venues.

The RM or MTF has the advantage of nondiscretionary (a.k.a. "deterministic") trading, and is subject to Open and Fair Access rules, opening up the liquidity of many participants. However, for some firms, especially larger ones, it may be advantageous to use a broker dealer’s SI, as this provides access to discreet, bilateral trading against the SI’s principal book. But the choices don’t stop there.

While the SI enables bilateral, negotiated trading, MTFs play a valuable role as market venues, enabling buy-side firms to choose between traditional central limit order book ("CLOB") trading, periodic auctions, RFQ, and quote-driven models. It is important to note that like SIs, both the RFQ and quote-driven venue models are bilateral trading protocols that allow trades to be negotiated between counterparties. In addition to the emergence of RFQs, conditional functionality is playing an increasingly important role in the market (see "Your Trading Choices").

To see or not to see: pre-trade price transparency waivers

Pre-trade transparency rules require SIs, RMs and MTFs to publish ("display") in real-time current orders and quotes relating to shares. But there are a number of waivers that allow participants to negotiate and execute trades in a way that limits pre-trade exposure, and as a result, the risks of market impact.

- LIS Order Waiver

- Orders (including quotes and actionable IOIs) above LIS do not need to be made pre-trade transparent. Can apply to price reference waiver and negotiated trade systems as well as orders and quotes in CLOB, quote-driven and RFQ systems.

- Price Reference Waiver

- Applies to a price reference waiver system. All trading must take place at the midpoint of the primary market or the most relevant market for the security in liquidity terms. Can also trade at the open and close price outside market hours. Subject to the double volume cap.

- Order Management Waiver

- Applies to orders held by a trading venue in a pending state ready to be released on the same terms as any other order entered into the system—for example, the hidden portion of an iceberg order.

- Double Volume Cap

- Suspends the price reference waiver and negotiated trade waiver for price-forming trades in liquid shares for six months for securities where more than 8% of pan-EU trading occurs under these waivers or where more than 4% occurs on a single venue.

- Negotiated Trade Waiver

- Trade negotiated bilaterally away from a trading venue and brought onto the venue for confirmation using a negotiated trade system.

- Price forming

- Liquid shares–must occur within the order book or quotes of the venue (subject to the double volume cap)

- Illiquid share–must occur within a reasonable price of the last trade on the venue

- Not subject to the current market price

- VWAP/TWAP–trade is executed at a benchmark price over multiple time horizons

- Portfolio trades–trade is executed simultaneously with five or more constituent shares

- Non-price forming

- Trade is executed for another reason such as to facilitate a clearing and settlement process

- Price forming

Your Trading Choices

As we’ve noted, the range of trading venues available to buy-side clients has opened up considerably in the past year, along with a marked growth in blocks in proportion to overall dark trading. While the venues differ in their approach, many are addressing a growing demand from buy-side institutions for more efficient ways to trade.

Central limit order book (CLOB)

The "granddaddy" of equity trading protocols. Provides open and fair access to all participants using a CLOB protocol. Most operate on a price-time priority, but some dark pools use price-size as an alternative matching logic. Used by traditional exchanges but market share has fallen under 50% following the opening up of venue types under MiFID I.

PROS Works well for high-volume trading activity and for smaller order sizes in liquid stocks. Can benefit from a price reference waiver for pre-trade transparency creating a continuously traded dark pool.

CONS Immediate market data dissemination means market price may move instantly as the market adjusts to small additions and subtractions from either side of the order book. Queuing at each price level means there is an incentive to create new venues providing additional parallel queues leading to liquidity fragmentation.

Periodic auctions

Alternative to continuous matching and has been used at either end of the trading day by RMs for many years to establish the opening and closing print. New order books holding very short periodic or dynamic auctions with prices within the European Best Bid and Offer ("EBBO"). Priority when allocating orders can vary between venues.

PROS Can provide larger executions with low market impact for large orders traditionally placed in dark books. Often able to sit passively without being disclosed until auction is triggered as well as liquidity-seeking orders. Indicative price/size of each auction is published but not imbalance, so it is considered pre-trade transparent and the dark pool double volume caps do not apply.

CONS Not truly a dark interaction so trade sizes above those on the lit order books may be hard to achieve. As price forming venues it may be difficult to ensure execution at the midpoint of the current spread, and as new concepts there has been substantial innovation around price forming and price protection mechanisms, making prices and excepted volumes harder to predict.

Request for quote (RFQ)

PROS No opportunity for broker dealer "last look". Reduces market impact by restricting pre-trade information disclosure. Full two-way transparency of potential counterparties and ability to put firms in competition to bid for orders.

CONS More complicated to implement than CLOB. No guarantee of identifying liquidity.

Actionable IOIs (AIOIs)

Offer significant promise for buy-side traders. Some SIs and Instinet’s request for quote venue support both IOIs and AIOIs in addition to firm quotes.

PROS Growing in popularity with buy-side firms and is part of RFQ venue and trading workflows.

CONS Have some associated perceptions linked to IOIs and the way they were used in the past.

Conditional interest

Rising in popularity. Conditional functionality enables order interest to be provisionally noted on multiple venues, but as soon as a firm opportunity is sourced on one venue, the order’s conditional interest must be removed from the other venues.

PROS Can be used with current dark LIS MTFs, and is intrinsic to RFQ functionality.

CONS Potential to further fragment the market or give the appearance of "phantom liquidity".

Quote driven markets

Bilateral privately negotiated trades which can occur both on or off venue against a market maker.

PROS Quote driven markets must require execution at or better than the quote of the market marker. Provides liquidity in more esoteric securities.

CONS Market makers act as principal, trading on risk and have discretion about who they choose to trade with and which orders they wish to take.

Off-venue crossing (negotiated trades)

Bilateral privately negotiated blocks off venue. Conducted in an EU regulated market security that is not subject to pre-trade transparency and on terms that are no worse than those that could be achieved on the relevant exchange order or quote book. Can reduce market impact by restricting pre-trade information leakage.

PROS Negotiated trades have no requirement to make the trade pre-trade transparent.

CONS Sub-LIS trades in liquid shares subject to the dark volume cap and all trades must be negotiated in a truly bilateral fashion without running a separate trading venue.

In the dozen or so years since the introduction of Regulation National Market System ("Reg NMS") in the US, debate has raged over the benefits of that new market structure. The "order protection rule" or "trade-through rule" provides inter-market price protection of orders by restricting the execution of trades on one venue at prices that are inferior to displayed quotations on another venue.

Introduced with the original goals of normalising price discovery and formation across Exchange and Off-Exchange venues and protecting the retail investor, since Reg NMS was created there’s little doubt that spreads have narrowed, pricing has sharpened and fees have fallen; but the proliferation of trading venues, growth in the role of dark pools, and significant percentage of liquidity generated by high-frequency trading firms has not provided for the transparency that Reg NMS originally intended, and sits uneasily with some constituents.

Regulators (and exchanges) have proposed different programmes to address the increase in off-exchange trading. The US Securities Exchange Commission is midway through conducting a two-year Tick Size Pilot Program that subjects groups of securities to prescribed minimum price increments (widening the tick size on certain smaller stocks), as well as the Trade-At rule, which prevents price matching by a trading venue not quoting at the protected bid or offer (inhibiting smaller increments of price improvement in off-exchange venues).

There are exemptions to Reg NMS dealing with situations where exchanges are having technical difficulties or the market is moving very fast. The most important exemption in terms of use is the intermarket sweep order ("ISO") which effectively relieves exchanges of the need to check protected quotations at other trading centers by placing the onus on the broker dealer. ISOs are limit orders that are routed to execute against the full displayed size of all protected quotations with prices that are better than the price of the ISOs, allowing a broker dealer to execute a trade immediately and ensuring that investors receive an execution price equivalent to what is being quoted on any other exchanges. For example, if an order router wishes to immediately access a large-sized quotation with a price inferior to protected quotations at other trading venues, it can route an ISO to execute against the large-sized quotation, while simultaneously routing additional ISOs to execute against all of the better-priced protected quotations.*

* Excerpted from: https://www.sec.gov/spotlight/ emsac/memo-rule-611-regulation-nms.pdf

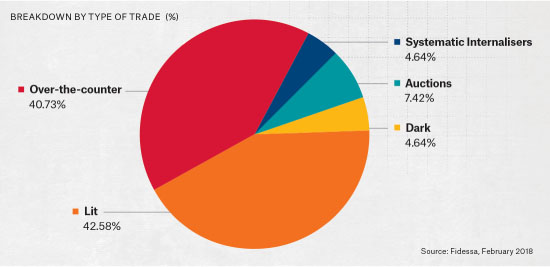

How the Market Currently Trades

The choice of execution venue depends on individual client requirements. This explains the widely-distributed breakdown of trading styles in Europe, with around 43% of volume being traded via lit markets, over 40% via OTC, and the remaining orders being completed via SI, auctions, and dark pools.

But there is perhaps no area more controversial in the US equity market than the subject of market data fees, which have been inexorably rising for years, and are one of the major reasons why the revenues of US exchanges continue to rise. In the US, the major exchanges contribute to—and earn revenue from—a Consolidated Tape, the Security Information Processor ("SIP"). They also sell, at a premium, separate slightly "faster" and richer data feeds to more demanding or sophisticated users.

While MiFID II forces exchanges to sell their data on a "reasonable commercial basis", there are widespread concerns about the cost of market data, which has risen sharply in recent years at the majority of European exchanges.

To combat this, MiFID II also introduced data disaggregation and free delayed market data, and has mandated ESMA to produce a European consolidated tape for equities if one does not surface within a few years. In the meantime, plans continue for competing, national versions.

Wouldn’t You, If You Could?

In the past year, there has been a marked increase in the use of conditional interest in Europe. While not strictly new to the market, its widespread deployment indicates the growing value it can provide in the current landscape. At its simplest, conditional interest is simply an IOI or an order that is dependent on other criteria being met. In the case of block trades, it can be used to advertise a trade on multiple venues simultaneously or enable buy-side firms to interact with sell-side conditional interest.

Once a potential match has been found, it can be followed-up with an order/RFQ as appropriate to the system. There is little doubt that the conditional interest functionality can enhance significant buy-side block liquidity and is now available on a number of MTFs, providing one more option for participants looking to execute a block trade.

Best execution should take into account more than just the fill price, and should include the cost of clearing and settlement. The decision of whether to use a central counterparty ("CCP") to clear trades is an important one, as it has implications on cost, efficiency, and security. For participants, there are four main choices:

- Bilateral settlement

- Single member clearing

- Single CCP e.g. Xetra, Borsa Italiana, BME and Equiduct

- Multi-CCP

- Open Access via preferred CCP e.g. Euronext

- Interoperable CCP e.g. CBOE, LSE, Turquoise, OMX and BlockMatch

CCPs have significant and growing advantages for participants, including reduced margin cost, flexible netting and settlement options, and robust default management procedures. In addition, there is considerable momentum behind the shift from bilateral settlement to central clearing, as regulators look to reduce systemic risk. Not all CCPs are interoperable, however, and those that do not provide "open access", risk participants clearing in a vertical monopoly.

MiFID II brings in the requirement for all trading venues (RMs and MTFs) to provide open access and open up trade feeds to any CCP that asks for one, ensuring non-discriminatory access to trading and clearing infrastructures. In short, trading venues should have non-discriminatory access to CCPs— allowing investors to trade on alternative platforms and benefit from lower trading fees across asset classes. Interoperability means allowing products traded on separate venues to be fully fungible. In other words, it allows CCPs to interconnect.

RFQ arrives on scene

While interest in conditional trading has been on the rise, the emergence of the RFQ as a potent tool in the buy-side armoury is definitely an innovation that the equity and in particular share trading market needs. The dominant trading protocol across the major ETF, bond, foreign exchange, derivatives, credit, and rates markets for decades, RFQ provides tailored liquidity and significantly reduces market impact.

RFQ is a private auction, with the buy-side firm soliciting firm quotes from one or more named counterparties. The buy-side firm provides the symbol, size, and side, and the sell-side recipients respond with firm quotes. While the quotes are firm from the sell-side, the buy-side trader is not obliged to trade at the levels they receive.

The RFQ has its limitations, specifically in the easy identification of large blocks of natural liquidity, but it has a range of benefits and recent innovations that will enable long-term viability. For example, our own BlockMatch RFQ combines RFQ with undisplayed IOIs for conditional trading and has LIS waivers for quotes and AIOIs that allow large orders to be shown privately without giving up market-moving information to the public. BlockMatch also has delayed reporting built in when one side of the trade is acting as principal—just like an SI. Instinet created this as an option for member firms that could benefit from central clearing through a trading venue rather than trading bilaterally OTC.

The model is similar to an off-venue negotiated trade and by its nature is private. It involves limited give-up of information and enables the buy-side firm to choose which counterparties they deal with. This can prevent orders being broken up by other orders, and reinforces the value of broker dealer relationships but is not restricted to buy-side to sell-side interaction, with new "all to all" models becoming more prevalent, including within BlockMatch. Inherently conditional in nature, RFQ venues can be enhanced by way of AIOIs, providing participants with pre-trade transparency and an on-venue alternative to accessing a bilateral counterparty.

Summary

Buy-side firms are becoming the proverbial "victims of choice", with more alternatives as well as increasing obligations related to their access to market liquidity. While the sharp rise in destinations and liquidity sources fuels concerns about further market fragmentation, conditional trading, in particular, means that there are now more and better ways to execute blocks than ever before. However, orders still need to be discreetly worked based on their goals—with the appropriate sensitivity to factors such as liquidity capture or information risk management.

As a result, there is an increasing role for alternative trading models that assist clients in seeking block-sized executions and enhancing execution quality—such as RFQ. While the benefits of conditional interest are now pretty familiar to most participants, the RFQ has not been widely used in the European equity markets outside of ETFs, until now. Given its primary role in trade execution across the fixed income, credit, and OTC derivatives markets, we think it is set to play a major role in expanding choices and offering new opportunities in the electronic trading of equities, on venue, for all participants for many years to come.

At the end of the day, trading venues and liquidity sources are of the most value when they are carefully chosen and engaged based on each order’s particular characteristics, market conditions, and the trader’s objectives. It’s important to not think in categorical terms, such as "should I interact with venue X?", but rather to develop a continually evolving strategy for "when and how to optimally interact with venue X".

As we mentioned in our previous publication, "Trading in the Age of Data", utilising post-trade information on a real-time basis is a critical component to the process of best execution. Buy-side clients should be applying this data to the process of venue selection as well as order management styles and processes, and must be aware of the pros and cons of all of these destinations, so they can manage their access, and their execution quality, accordingly.

Glossary of Terms

- Actionable Indication of Interest (AIOI)

- A firm quote from one member or participant to another in response to a request for quote that contains all necessary information to agree on a trade (see also Indication of Interest).

- Agency Broker

- A broker who acts as an agent for a client and trades on their behalf.

- Auction

- Buyers and sellers submit orders that are crossed at a point in time at the price which maximises the total size of the match.

- Authorised Publication Arrangement (APA)

- A person authorised under the provisions established in the MiFID II directive to provide the service of publishing trade reports on behalf of investment firms.

- Bilateral

- An agreement negotiated between two parties (see also Negotiated Trade or Over-the-Counter).

- Block

- Large-sized securities transaction to be bought or sold by institutional investors for scale and price benefits (see also Large-in-Scale).

- Cash Equities

- Stocks, equities, or equity securities traded by institutional investors or large financial institutions on major exchanges.

- Central Counterparty (CCP)

- Sits between the participants in a trade. Manages and mutualises counterparty, operational, settlement, market, legal and default risks for market participants.

- Central Limit Order Book (CLOB)

- A centralised, transparent system used to aggregate all limit orders on a platform and facilitate trading between counterparties.

- Conditional Interest

- An indication of interest to execute an order contingent upon certain stipulations that must be met before the order can be fulfilled (see also Indication of Interest).

- Crossing Network

- A network that provides an alternative trading system (ATS) for buyers and sellers to match for execution without going through an exchange.

- Dark

- Trading protocol with complete counterparty anonymity and lack of transparency into liquidity or orders unless matches are made.

- Dark Pool

- A venue for trading securities in which investors can makes trades that are not visible to anyone until executed.

- ESMA (European Securities and Markets Authority)

- An independent EU Authority that contributes to safeguarding the stability of the European Union’s financial system by enhancing the protection of investors and promoting stable and orderly financial markets.

- Exchange

- A regulated market where brokers and traders buy and sell securities, commodities, derivatives, currencies, and other financial instruments (see also Regulated Market).

- Exchange-Traded Fund (ETF)

- A security that closely tracks an index, commodity or a basket of assets, but trades like shares of stock on an exchange.

- Financial Conduct Authority (FCA)

- The conduct regulator for financial services firms and financial markets in the UK and the prudential regulator for over 18,000 of those firms.

- High-Frequency Trader (HFT)

- A trading firm that uses computing power and algorithms to execute large quantities of orders at exchanges triggered by information or data cues.

- Impact

- Unintended shifts in market pricing and behavior based on the trading

- Indication of Interest (IOI)

- Showing a buyer’s non-binding interest in buying a security that is addressed to the seller.

- Information Leakage

- Unintended dissemination of a firm’s proprietary pricing and trading information that could allow competing traders to adjust behaviours to the detriment of the firm.

- Intermarket Sweep Order ("ISO")

- A type of limit order submitted to a US exchange for automatic execution in a particular market center even when a different exchange is posting a better price.

- Large-in-Scale (LIS)

- An order that is equal to or larger than the minimum size of order specified in Table 2 in Annex II of the MiFID Implementing Regulation (RTS1) (see also Block).

- Liquidity Provider

- A firm which posts bids and offers on a trading venue generally using a market making strategy with the objective of capturing short term imbalances in the market (see also Market Maker).

- Lit Market

- The opposite of a dark pool, bids and offers are made public ("displayed") in real time.

- Markets in Financial Instruments Directive II (MiFID II)

- European Union (EU) legislation which regulates investment firms/institutions that provide services related to "financial instruments".

- Markets in Financial Instruments Regulation (MIFIR)

- European Union (EU) law that is a sister regulation to MiFID II.

- Market Maker

- A firm that buys and sells securities as principal in order to provide liquidity to a trading venue or the market in general (see also Liquidity Provider).

- Midpoint Order

- An order type designed to facilitate trade execution at the midpoint of the bid-offer spread.

- Multilateral Trading Facility (MTF)

- A European regulatory term for a trading venue that facilities crossing through electronic platforms, as an alternative to traditional stock exchanges.

- National Best Bid and Offer (NBBO)

- A SEC regulation that requires brokers to execute customer trades at the best available ask price when buying securities, and the best available bid price when selling securities.

- Negotiated Trade

- A transaction that is negotiated bilaterally between buyer and seller (see also Bilateral or Over-the-Counter).

- Off-Exchange or Off-Venue

- Trading activity that is not processed through a central exchange or trading venue.

- Organised Trading Facility (OTF)

- A multilateral system that allows the matching of non-equity securities at the discretion of the operator.

- Over-the-Counter (OTC)

- A contract between two parties that does not involve a central exchange or counterparty (see also Bilateral or Negotiated Trade).

- Periodic Auction

- A system where securities are sold at specific times to aggregate liquidity and facilitate competitive bidding.

- Regulated Market (RM)

- MiFID term for a primary exchange (see also Exchange).

- Request for Quote (RFQ)

- A trading protocol in which a participant invites one or more other participants to offer a quote for securities or trading instruments.

- Share Trading Obligation

- Requirement under MiFID II for investment firms to ensure that the trades they undertake in shares admitted to trading on a regulated market, or traded on a trading venue, take place on a regulated market, MTF, systematic internaliser, or an equivalent third-country trading venue.

- Small Medium Enterprise (SME)

- Firms in which employees and assets are below a certain threshold.

- Standard Market Size (SMS)

- A MiFID order size threshold for systematic internalisers below which quotes must be made public.

- Systematic Internaliser (SI)

- An investment firm, in which, on an organised, frequent systematic and substantial basis, deals on own account when executing client orders outside a regulated market, an MTF or an OTF without operating a multilateral system.

- Trading Venue

- Includes MTFs and RMs, where securities are exchanged.

Benjamin Stephens

benjamin.stephens@instinet.co.uk

T: +44 207 154 8743

Salvador Rodriguez

salvador.rodriguez@instinet.co.uk

T: +44 207 154 7252