Execution Services

Experience the pinnacle of agency-model* trading.

At Instinet, execution quality isn’t just an outcome, it’s a process—a commitment to maximize efficiency and optimize performance at every point in the trade life cycle.

Across all of our trade execution and post-trade capabilities, we combine the talent of our teams with the power of our technology to help streamline your trading workflow, improve performance, and lower your overall trading costs.

How we give our clients an edge

Deep market insight

Our value as a trading partner is rooted in our deep understanding of today’s complex market structure, and we provide regular market commentary and execution consulting to help you navigate the challenges and take advantage of the opportunities.

Proven technology innovation

Our award-winning trading platforms, advanced algo strategies, and global low-latency infrastructure deliver consistent best-in-class performance, day in and day out.

Coordinated expertise

Our teams of sales traders, analysts, quants, and algo engineers work together to apply their insights, tactical knowledge, and mastery of our technology to your objectives.

High-quality service

Impartial consultation and continuous collaboration are the essence of the agency model, and part of every trading and technology relationship at Instinet, high-touch or electronic.

Access to diverse liquidity

We have the expertise, deep connections, and global infrastructure to connect our clients to the high-quality liquidity they need, when they need it, and where they trade.

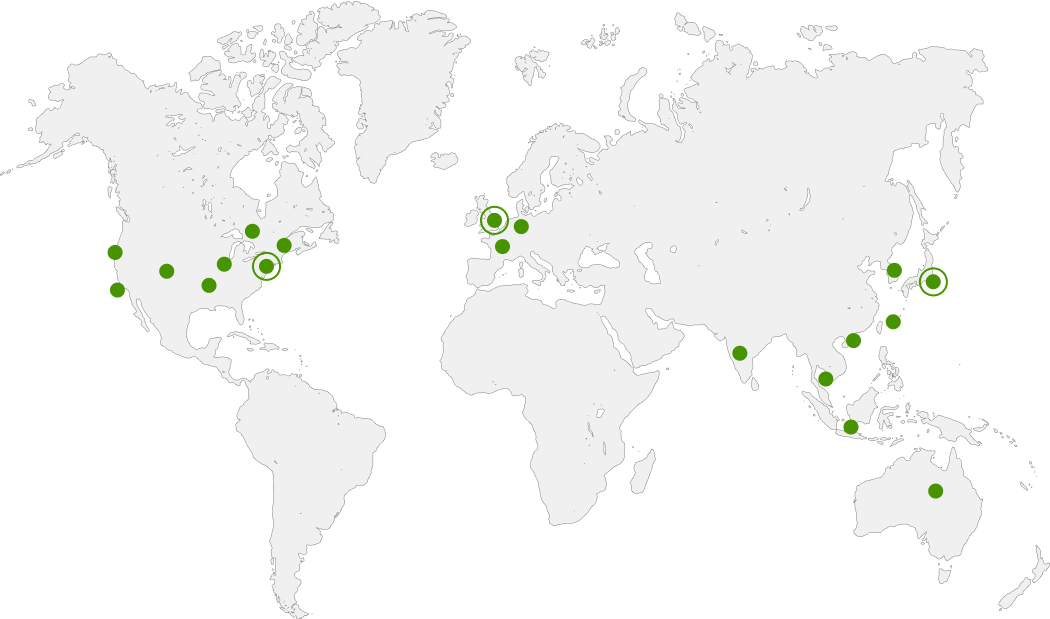

Coverage

Our traders access liquidity from hundreds of exchanges and venue destinations globally across every MSCI developed and emerging market and a majority of frontier markets.

Wolfe Research

Through the Strategic Alliance with Wolfe Research, Instinet trading clients can access and pay for Wolfe’s independent equity research, covering 700+ stocks across all major global industries.

Locations

We operate 14 global full-service, 24/6 trading desks and connect clients seamlessly to Nomura’s regional trading capabilities in Japan.

Boston

Denver

Geneva

Los Angeles

New York

Rye Brook

St. Louis

Toronto

Frankfurt

London

Paris

Hong Kong

Singapore

Sydney

Tokyo/Nomura

Post-trade Workflow

We continue to help you streamline, automate, and customize your workflow post-trade, providing integrated middle & back office technology, agency clearing & settlement solutions, and a comprehensive commission management platform.