Instinet Canada Cross Limited (ICX)

ICX operates an alternative trading system (ATS) available to Canadian registered Investment Dealers and their clients to trade Canadian listed equities. ICX provides a VWAP (Volume Weighted Average Price) cross and Continuous Block Cross ("CBX") dark pool to the Canadian market. ICX participants may also send conditional orders to the ICX Conditional Order Book.

ICX is based on Instinet's proven, liquid, globally-deployed dark pool model, and is powered by Instinet's proprietary matching technology that was designed to maximize speed, performance and reliability.

Market Type

Alternative Trading System (ATS).

Securities Traded

All listed Canadian securities denominated in Canadian and US dollars.

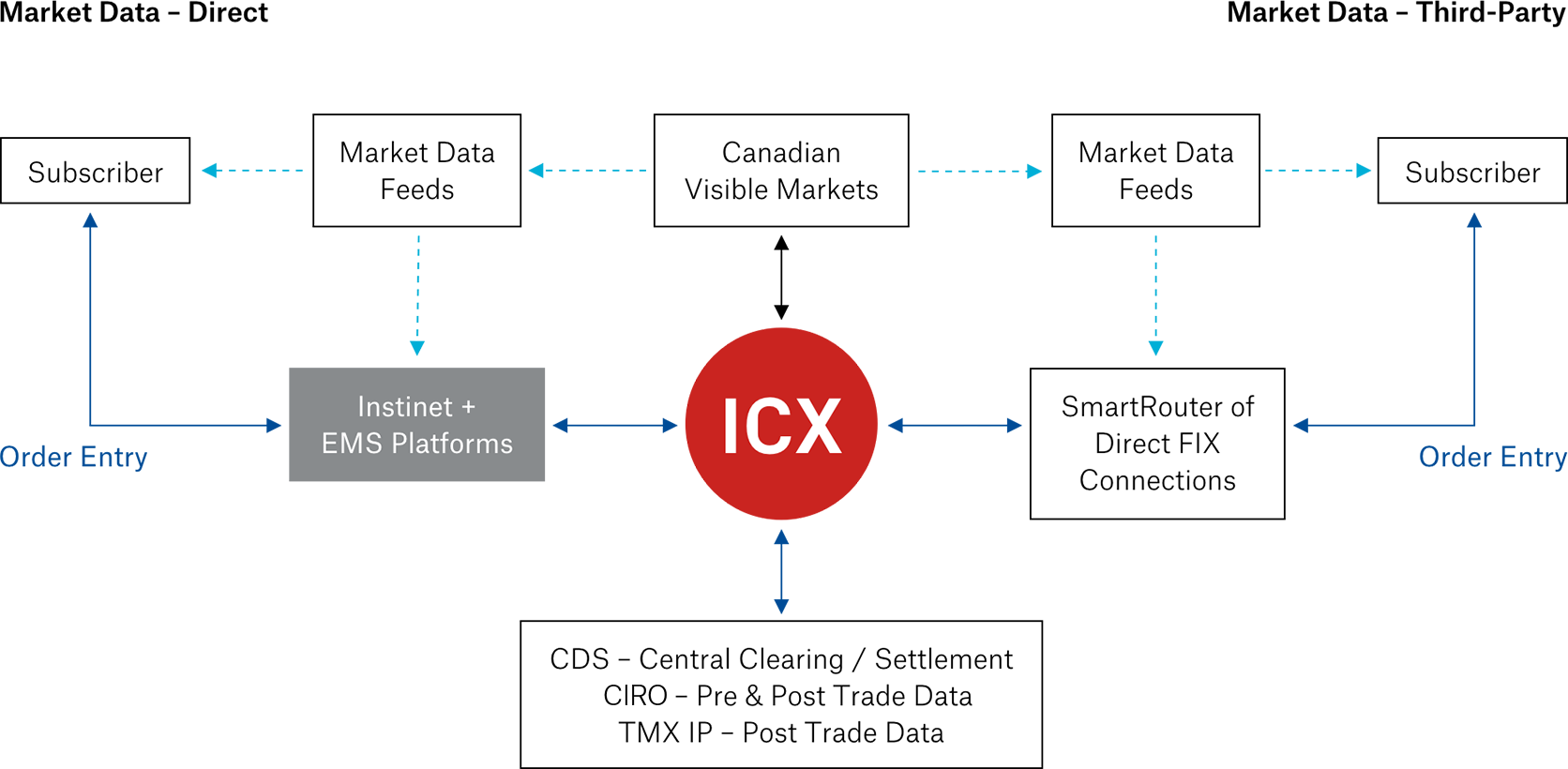

Market Data

No quotes are published by ICX, nor IOIs generated.

Prints are disseminated electronically through third-party data vendors such as TMX Information Processor (TMX IP), TMX Datalinx, Bloomberg® and Thomson Reuters®.

Order Entry

Industry-standard FIX protocol order entry via third-party and proprietary execution management systems. Cross connect at primary site (Equinix TR2) or secure connection via approved Extranet service providers.

| ICX VWAP | ICX CBX | ICX Conditional Order Book | |

| Type | Point-in-time Cross | Continuous Cross | Continuous Cross |

| Execution Priority | Pro-rata basis | Price / Broker / Time | Price / Broker / Time |

| Match Time | 9:15 AM | 9:30 AM - 4:00 PM | 9:30 AM - 4:00 PM |

| Pricing | Canadian Consolidated VWAP (priced at ~ 4:10 PM) | NBBO mid-point real time | NBBO mid-point real time |

| Order Functionality | Market, minimum fill, cash consolidated on baskets | Market, limit, minimum fill, time-in-force | Market, limit, minimum fill, time-in-force |

| Description | Benchmark cross, execution locked at match time, priced after close | Low latency, continuous limit order book. Provides broker-time priority matching in an anonymous or trade-attributed environment | The ICX Conditional Book receives conditional orders and manages the identification and notification of contra liquidity. Upon an identification of a match, firmed up orders are submitted and executed within the ICX CBX Continuous Cross |

Market Overview

VWAP Cross

The VWAP Cross provides a benchmark cross at the day's VWAP (Volume Weighted Average Price). VWAP is a standard trading benchmark for the average price level of a stock, which is a ratio of the value traded to the total volume traded over a particular time horizon (in this case, for the day). ICX calculates the daily Canadian VWAP for listed stocks based on real-time feeds from consolidating all visible Canadian marketplaces.

ICX runs the VWAP Cross just prior to the TSX market open, locking in executions at the match time. These executions are then priced after the market close, once the stock's volume weighted average price has been determined using the day's consolidated market data feeds from all visible CDN markets.

The VWAP Cross supports market orders, minimum fills and cash constraints on baskets.

Continuous Block Crossing (CBX)

CBX is a low latency continuous limit order book with the following features.

CBX has been designed for price improvement and anonymous trading. CBX is a low latency continuous limit order book with the following features:

- Dark pool with no displayed orders

- Broker- time priority. There is no preferencing of orders by any other criteria

- All matches will occur at the mid-point of the National Best Bid Offer ("NBBO")

- ICX supports all advance order types, including limit, minimum fill and time-in-force

- Only board lots will be traded

- Matches will only occur during the primary market hours of operations once the stock has been deemed open in the primary market

- No matches will occur if the NBBO is locked or crossed

Orders are sent into CBX. Market and limit orders designated IOC or FOK are, if not matched in CBX cancelled back to the subscriber. When at least one board lot can be matched, the CBX price is set by calculating the NBBO midpoint at the time of the match. Once the price is set, the match executes based on broker-time priority. Prints are sent to subscribers, the IP and CIRO.

Market Type

Alternative Trading System (ATS).

Market Operation

CBX Cross continuous block crossing with all matches occurs at the mid-point of the NBBO

Securities Traded

All Canadian listed equity securities.

Market Data

No IOI's or Quotes on Orders will be disseminated. Prints will be disseminated electronically through third-party data vendors such as TMX Information Processor, TMX Datalinx, Post-trade transparency with time & sales data.

CBX calculates the NBBO midpoint on a continuous basis.

Order Entry

Industry-standard FIX protocol order entry via third-party and proprietary execution management systems. Cross connect at primary site (Equinix Front Street) or secure connection via approved Extranet service providers. Order functionality for all Crosses includes limits, minimum fill and time in force.

Trading Hours

ICX's CBX allows subscribers to trade between the hours of 9:30 a.m. and 4:00 p.m. (Eastern Time) on trading days once the primary market has deemed the stock to be open.

Holiday Schedule

The system will be available for trading on all business days – Monday through Friday inclusive – excluding Canadian Statutory Holidays.

Order Entry Interface

FIX, or Financial Information eXchange, is an industry standardized protocol that allows ICX subscribers to enter, revise and cancel orders, and receive executions. It allows subscribers and their software developers to integrate ICX into their proprietary trading systems or build custom front ends. All orders are entered via FIX into the Core Matching Engine in the ICX FIX protocol, with Canada-specific and UMIR required fields.

ICX destinations are available on Instinet's EMS platforms such as Newport and Portal and other EMS/OMS to allow for access and connectivity from those platforms.

Conditional Orders

ICX participants may send conditional orders to the ICX Conditional Order Book. Conditional orders are non-firm indications of trading interest which cannot by themselves result in an executed trade and only interact with other conditional orders or firm orders that have elected to interact with conditional orders. In the event of a match on the ICX Conditional Order Book, each conditional order will be cancelled back in full and the participant will receive an invitation to “firm up”. Subscribers may then respond by submitting a firm order to the ICX CBX book, where the normal ICX execution protocols will apply.

Matching Engine – The ICX Alternative Trading System utilizes existing Instinet proprietary Crossing technology. Instinet operates several ATS around the globe utilizing its proprietary technology. All ICX orders are fully anonymous. ICX is a dark pool with no IOI's or quotes being disseminated to any subscriber.

Orders entered into CBX that are not matched, unless IOC or FOK, are "posted" in the engine's order book, a dynamically updating real-time database of limit orders, so they can be subsequently matched. No IOI's and quotations for orders posted in the ICX book will be disseminated to system subscribers. No subscriber's identity is disclosed pre-trade or during the execution process. Full post-trade transparency will be available.

Minimum Price Increment – ICX's CBX's dark pool will allow the entry of orders in the minimum tick increment allowed by UMIR:

- For stocks with a previous close price >= $.50 a minimum price increment of $.01 CAD

- For stocks with a previous close price < $.50 a minimum price increment of $.005

Minimum Volume Increment – CBX Cross will have a minimum volume of one board lot and allow 100 share increments.

ICX Order Handling

Multiple solutions to access matches:

- Secure connection via approved Extranet service providers.

- Direct from subscribers EMS or OMS systems.

- Cross connects at primary location.

ICX Pricing

ICX pricing mechanisms for CBX are that matched orders meeting regulatory minimums for board lots are priced using the NBBO mid-point at the time of the match.

Halts, Delayed Opens and Adherence to Primary Market (TMX)

ICX will halt and open securities in-line with the primary market. Similarly Delayed Opens and other market events imposed by the primary market will be followed. A halted security may still have a match and trade in the VWAP Cross while open and the VWAP will be calculated based on the trading day. A security that does not open on a particular day will not receive matches that day.

| Market place event | Market place facility used | Description of Order Treatment |

|---|---|---|

| Delayed open or Halt before open | CBX | CBX will accept orders and match dependent on security opening. |

| Security does not open | CBX | Orders and matches will be rejected. |

| Halted during day and reopens | CBX | CBX will accept orders. |

| Halted during day and does not reopen | CBX | CBX will accept orders while open. |

CBX Order Types

Supports Market Order, Limit Order, Volume, Minimum Fill (Pro rata), Expiration (Day, GTD). Conditional Orders are accepted by the ICX Conditional Order Book.

Time in Force Conditions

DAY – A day order will remain live on the ICX book for the duration of the trading day or until cancelled in the course of the trading day by the subscriber. At the end of the ICX trading day (4:00 pm Eastern Time) all outstanding, unfilled Day orders will be cancelled.

GTD – A “Good 'Til Date" (GTD) order expires at the end of the ICX trading day (4:00 pm Eastern Time) specified.

All orders that remain on the ICX book expire and are cancelled at the end of the ICX trading day (4:00 pm Eastern Time).

CBX Orders & Pricing Process

- Accumulation: Orders are sent in to CBX. Market and limit orders, designated IOC or FOK, are, if not matched in the CBX, cancelled back to the subscriber.

- When at least one board lot can be matched, the CBX price is set by calculating the NBBO midpoint at the time of the match. Once the price is set, the match executes based on broker- time priority.

- Prints: Prints on ICX are sent to subscribers, the IP and CIRO.

ICX Special Cases and Special Terms Order Handling

| Order Type | Order Treatment | Description |

|---|---|---|

| Opening Orders | REJECT | Limit/ Market On Open orders are not available and rejected. |

| CBX Market/Limit Orders Pre-9:30 a.m. | CBX Cross | Market and Limit Orders pre-9:30 go directly to the CBX order book as an open order. |

| CBX Market/Limit Orders between 9:30 a.m. and 4:00 p.m. | CBX Cross | CBX Market and Limit Orders between 9:30 and 4:00 go directly to the order book as an open order. Rejected post 4:00. |

| Closing Orders | REJECT | Limit On Close orders are not available and rejected. |

| Odd Lots | REJECT | Orders less than one board lot will be rejected. |

| Special Terms Limit Order | VWAP and CBX | Some Special Terms orders will be accepted such as FOK, and MinQty parameters. |

Publication of Pre and Post Trade Information

A pre and post trade data feed will be available to CIRO. Post trade data will be sent to CDS, CIRO and TMX IP for post trade transparency. The post trade data feed will continue to be offered to all clients and vendors who sign a contract of use.

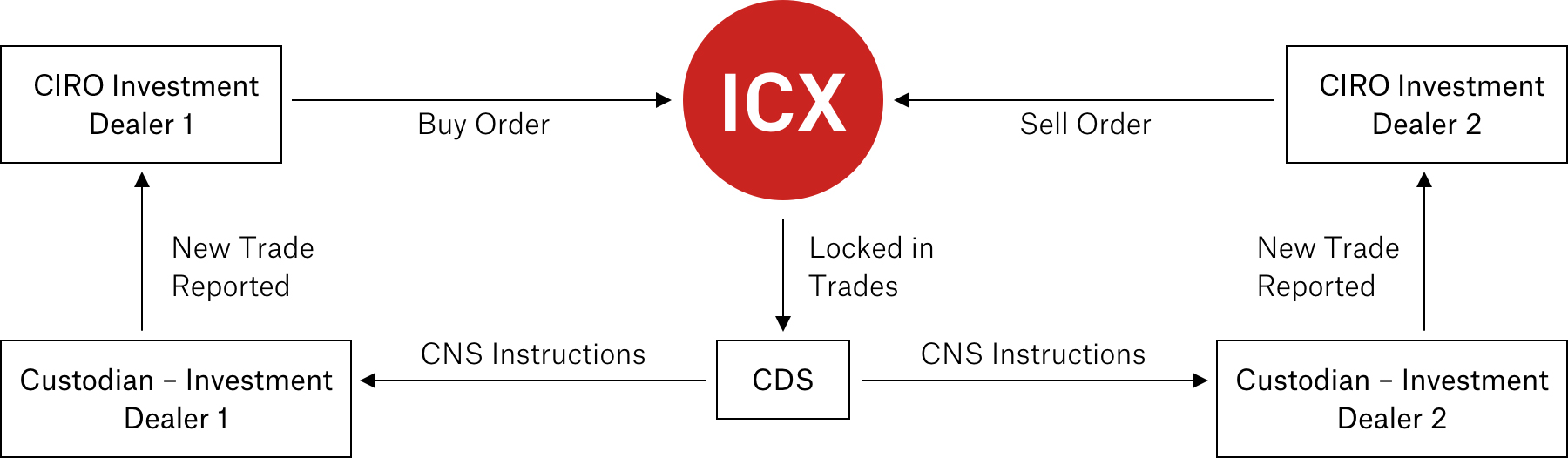

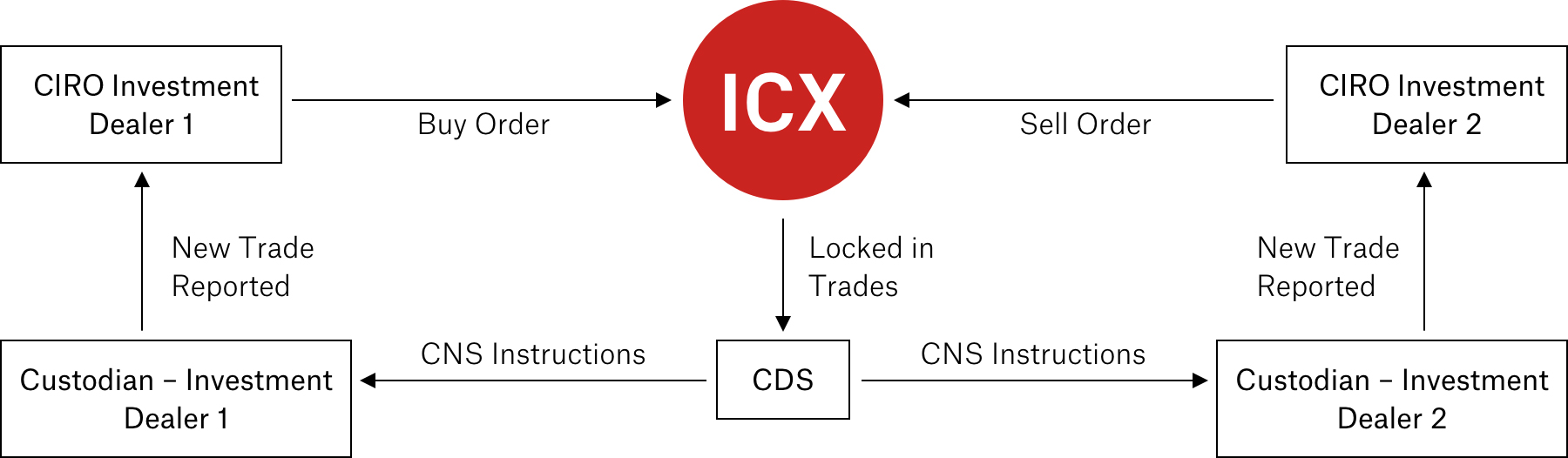

Clearing

ICX operates under the ATS clearing model.

Locked-in subscriber trades are reported at the end of the day by ICX to CDS. Identity of the counter-party will be disclosed in files sent to CDS for settlement purposes.

Subscribers report the trades to their custodians who will in turn report allocations to CDS

On T+1 ICX subscribers review the CDS trade comparison reporting based on trades submitted to CDS from ICX and the custodian

On settlement date CDS, via the CNS process, will debit/credit subscriber custodians' CDS ledger and bank account for the trades.

Settlement

All trades done on ICX will settle regular way on T+2.

In the case of a special direction for clearing and settlement from the primary exchange, ICX will make the appropriate adjustments to indicate the special clearing, (as agreed upon with CDS) to ICX's end of day file before the file is shipped off to CDS.

Definition - the execution of an order to buy, sell, or sell short a security, entered in error (e.g. in terms of price, quantity, side or symbol) at a price substantially away from, or inconsistent with, the prevailing market price for that security at the time of execution.

Trade rulings are made exclusively by CIRO.

ICX reserves the right to initiate a review of a clearly erroneous transaction, regardless of whether or not a member request has been submitted, if it determines in its sole discretion that circumstances warrant such a review. If all subscribers involved with the trade consent, ICX will cancel or amend the trade or details subject to the approval of the regulation service provider.

ICX will facilitate the cancellation of any transactions where the regulation service provider has determined the transaction is null and void. If the regulation service provider determines that an amendment of a material term is necessary, ICX shall instruct the relevant parties to cancel and correct the execution.

ICX Marketplace Technical Specifications

Instinet Canada Cross Application Notes available at www.icxats.com/technical.

Trading Hours

The ICX VWAP Cross allows subscribers to access the point-in-time cross for all Canadian listed equities. Orders may be entered starting at 7:00 am Eastern Time and the first match time will occur at 9:15 am Eastern Time. If demand warrants it, additional matches will be considered at 8:35 am and 8:50 am. Matches use the Canadian Consolidated VWAP price, calculated at 4:10 pm.

ICX's CBX shall allow subscribers to trade between the hours of 9:30 a.m. and 4:00 p.m. (Eastern Time) on trading days once the primary market has deemed the stock to be open.

- New Year's Day - Wednesday, January 1, 2025

- Family Day - Monday, February 17, 2025

- Good Friday - Friday, April 18, 2025

- Victoria Day - Monday, May 19, 2025

- Canada Day - Monday, July 1, 2025

- Civic Holiday - Monday, August 4, 2025

- Labour Day - Monday, September 1, 2025

- Thanksgiving Day - Monday, October 13, 2025

- Christmas Day - Thursday, December 25, 2025

- Boxing Day - Friday, December 26, 2025

Subscriber Notices

Clearing and Settlement

ICX operates under the ATS clearing model.

- Locked-in subscriber trades are reported at the end of the day by ICX to CDS.

- Subscribers report the trades to their custodians who then, in turn, report allocations to CDS.

- On T+1, ICX subscribers review the CDS trade comparison reporting based on trades submitted to CDS from ICX and the custodian.

- On settlement date CDS, via the CNS process, debits/credits the subscriber custodians' CDS ledger and bank account for the trades.

All trades done on ICX settle regular way on T+2.

In the case of a special direction for clearing and settlement from the primary exchange, ICX makes the appropriate adjustments to indicate the special clearing (as agreed upon with CDS) to ICX's end of day file before the file is shipped off to CDS.