End-to-end international basket trading with one global team.

Our global portfolio traders and sales staff are supported by a team of index market specialists, algorithmic engineers, technologists, and product specialists. They combine their multidisciplinary expertise to deliver customized execution strategies built for today’s complex markets, and tailored to your specific portfolio objectives.

Comprehensive global coverage

Portfolio desks in the Americas, EMEA, and APAC seamlessly pass trades, allowing portfolios to be worked 24x6 in 60+ markets.

100% MSCI/FTSE Developed and Emerging Markets

100% MSCI/FTSE Emerging

80% Frontier Markets

Centralized and integrated capabilities

Unlike many other firms, our global portfolio trading team leverages the same execution platform globally, allowing us to handle complex, multi-market instructions and baskets.

Why choose Instinet to trade your portfolios?

- A single global trading platform

- A consistent trading experience and workflow across markets

- An in-depth understanding of global trading costs

- One point of contact for complicated, multi-region trades

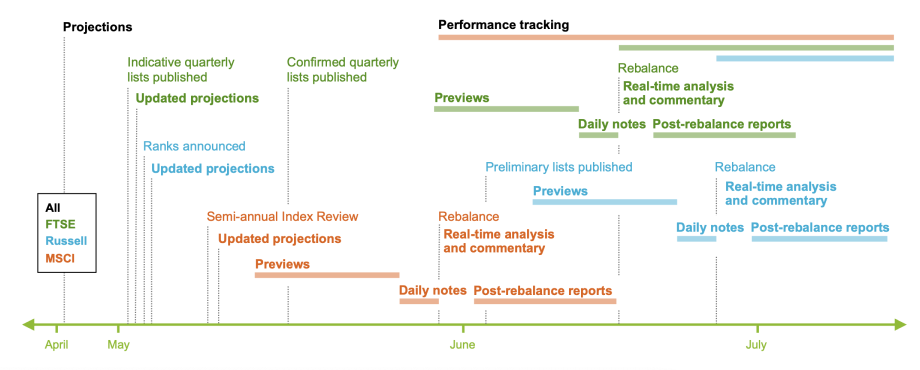

Global index analysis

We provide eligible trading clients with regular analysis of the effects of corporate actions on the major global indices and projections on the impact of those rebalances, as well as custom, client-driven index analysis projects.

To help clients confirm their own projections and strategies, or create and implement new trading ideas, we offer detailed data and unbiased insights for 30+ indices.

- Daily/weekly corporate actions

- Rebalance projections

- Consolidated rebalance liquidity analysis

- Intraday rebalance performance

- Trade performance before and after the rebalance date